Contents:

First, one needs to start a loan with a rate of interest he is eligible for; then, when the business starts growing, he can refinance the loan at a lower rate after some months of the loan. Let’s see an example to understand the cost of debt formula in a better manner. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The “effective annual yield” could also be used , but the difference tends to be marginal and is very unlikely to have a material impact on the analysis. If the company were to attempt to raise debt in the credit markets right now, the pricing on the debt would most likely differ.

- When the cost of debt is mentioned without qualification, it usually refers to the before-tax cost of debt, though it depends on context.

- Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

- Let’s see an example to understand the cost of debt formula in a better manner.

- Equity financing tends to be more expensive because of the higher returns yielded from the stock market.

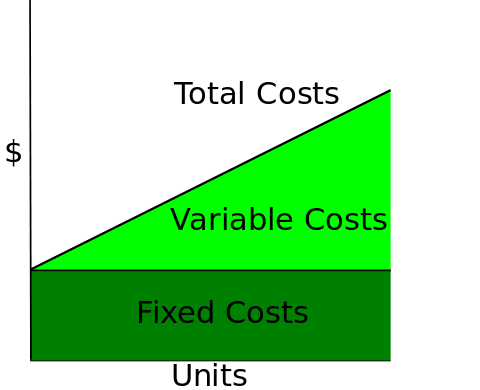

- In general, assets are things that the company truly own as well as other things that belong to someone else .

The balance sheet distinguishes between current and non-current assets and between current and non-current liabilities unless a presentation based on liquidity provides more relevant and reliable information. Of the AFP survey respondents, 46% estimate an investment’s cash flows over five years, 40% use either a 10- or a 15-year horizon, and the rest select a different trajectory. If we have to compare cost of debt with cost of equity, then we have to calculate it after adjustment of tax because interest is deducted from profit before tax but dividend is deducted from profit after tax.

As the company pays a 30% tax rate, it saves $1,500 in taxes by writing off its interest. As a result, the company effectively only pays $3,500 on its debt. Since observableinterest rates play a big role in quantifying the cost of debt, it is relatively more straightforward to calculate the cost of debt than the cost of equity. Not only does the cost of debt reflect the default risk of a company, but it also reflects the level of interest rates in the market. In addition, it is an integral part of calculating a company’s Weighted Average Cost of Capital or WACC. It boils down to the effective interest rate that a company pays on its debts, such as loans or bonds.

Bank says that you need to pay 10% interest over and above the principal amount you borrow. To put it another way, the more prosperous a firm is or will be, the more expensive it is to give up the equity because it is better for an owner to just keep the profits and pay the interest. Next, we’ll calculate the interest rate using a slightly more complex formula in Excel.

Nav’s Verdict: Cost of Debt

It is computed as the product of the total number of outstanding shares and the price of each share. But if you are one of those who would like to know how weighted average cost of capital works, here’s the formula for you. Low-interest business loans are the finest, but if your business or personal credit rating isn’t strong enough, you may not be eligible for those lower rates.

For nonrated firms, the analyst may estimate the pretax cost of debt for an individual firm by comparing debt-to-equity ratios, interest coverage ratios, and operating margins with those of similar rated firms. Alternatively, the analyst may use the firm’s actual interest expense as a percent of total debt outstanding. Some analysts prefer to use the average yield to maturity of the firm’s outstanding bonds.

Using Debt or Alternatives to Raise Capital

This spread, by the way, is called the Economic Value Added and, as you can see, can be positive or negative. In other words, two companies in similar businesses might well estimate very different costs of equity purely because they don’t choose the same U.S. Treasury rates, not because of any essential difference in their businesses. And even those that use the same benchmark may not necessarily use the same number.

https://1investing.in/es return the loans with interest over several months or years, depending on the loan agreement terms. Finally, to calculate the after-tax cost of debt, simply subtract the company’s marginal tax rate from one and then multiply the result by the effective tax rate you found earlier. Ltd has taken a loan of $50,000 from a financial institution for five years at a rate of interest of 8%; the tax rate applicable is 30%. Ltd has taken a loan from a bank of $10 million for business expansion at a rate of interest of 8%, and the tax rate is 20%. With debt equity, a company takes out financing, which could be small business loans, merchant cash advances, invoice financing, or any other type of financing.

Cost of Debt — Public vs. Private Companies

If you have high interest payments on one or more loans, consider consolidating at a lower rate. To calculate the weighted average interest rate, divide your interest number by the total you owe. This formula is useful because it takes into account fluctuations in the economy, as well as company-specific debt usage and credit rating.

It’s difficult to calculate the market value of debt because very few firms have their debt in outstanding bonds. Initial Public OfferingsAn initial public offering occurs when a private company makes its shares available to the general public for the first time. IPO is a means of raising capital for companies by allowing them to trade their shares on the stock exchange. Due to the obvious difference in the corporate tax treatment of interest and dividends, debt is also less expensive than equity from a company’s perspective.

Humana Inc. (NYSE:HUM) Shares Could Be 49% Below Their Intrinsic Value Estimate – Simply Wall St

Humana Inc. (NYSE:HUM) Shares Could Be 49% Below Their Intrinsic Value Estimate.

Posted: Thu, 13 Apr 2023 11:01:05 GMT [source]

An understanding of the balance sheet enables an analyst to evaluate the liquidity, solvency, and overall financial position of a company. Most U.S. businesses are not adjusting their investment policies to reflect the decline in their cost of capital. The Association for Financial Professionals surveyed its members about the assumptions in the financial models they use to make investment decisions. The answers to six core questions reveal that many of the more than 300 respondents probably don’t know as much about their cost of capital as they think they do. When investing in a business project or opportunity, you need to see a return worth the risk. We accept payments via credit card, wire transfer, Western Union, and bank loan.

Is Your Idea Worth the Investment?

Businesses that don’t pay attention to cost of debt often find themselves mired in loan payments they can’t afford. Know what the true cost of borrowing money is before you take out a loan and compare products and rates to get the best deal possible. Let’s say you want to take out a loan that will allow you to write off $2,000 in interest for the year. If the cost of debt is less than that $2,000, the loan is a smart idea. But if it’s more, you might want to look at other options with lower interest cost.

- Liabilities are loans used to purchase assets , like equipment, according to The Balance.

- As the company pays a 30% tax rate, it saves $1,500 in taxes by writing off its interest.

- Rate Of Return ExpectedThe hurdle rate in capital budgeting is the minimum acceptable rate of return on any project or investment required by the manager or investor.

- It is also known as the company’s required rate of return or target rate.

Insert all your liabilities in your balance sheet under certain categories. To calculate current liabilities, you need to add together all the money you owe lenders within the next year . To calculate total liabilities, check the list of liabilities in the above section. Then add up all the ones that apply to your business to calculate total liabilities. A balance sheet generated by accounting software makes it easy to see if everything balances.

Under IFRS, property used to earn rental chart of accounts example or capital appreciation is considered to be an investment property. IFRS provide companies with the choice to report an investment property using either a historical cost model or a fair value model. Property, plant, and equipment are tangible assets that are used in company operations and expected to be used over more than one fiscal period. Examples of tangible assets include land, buildings, equipment, machinery, furniture, and natural resources such as mineral and petroleum resources.

In debt financing, one business borrows money and pays interest to the lender for doing so. Conventional financial wisdom recommends that companies establish a balance between equity and debt financing. It’s crucial to choose the options that are most suitable for your staff, shareholders, and existing clientele. Debt financing tends to be the preferred vehicle for raising capital for many businesses, but other ways to raise money exist, such as equity financing.

Small Credit Unions Are Thriving – Credit Union Times

Small Credit Unions Are Thriving.

Posted: Fri, 14 Apr 2023 18:45:49 GMT [source]

It also proves helpful in determining the company’s risk level compared to others. A high cost of debt can also give investors information about how risky a company is in comparison to others. A higher cost of debt indicates that the company is more vulnerable.

Cost of equity is calculated using the Capital Asset Pricing Model , which considers an investment’s riskiness relative to the current market. The weight of the common equity component is computed by dividing the product of a market value of stock and the great number of shares by the total capital invested in the business. However, WACC is a bit complex and needs a financial understanding to calculate the Weighted Average Cost of capital accurately. Only depending on WACC to decide whether to invest in a company or not is a wrong idea. Investors should also check out other valuation ratios to make the final decision. Financial RatiosFinancial ratios are indications of a company’s financial performance.

The key difference between the pretax cost of debt and the after-tax cost of debt is the fact that interest expense is tax-deductible. Calculating the cost of debt using the after-tax cost of debt formula is a simple process once you know where to find the inputs and the reasoning behind the line items. Okay, now that we have some numbers, we can calculate our after-tax cost of debt for Microsoft. A company’s income tax will be lower because of the deduction of the interest component from taxable income. There are a couple of scenarios to consider when looking at the capital structure and how different companies finance their growth.

The cost of debt can refer to the before-tax cost of debt, which is the company’s cost of debt before taking taxes into account, or the after-tax cost of debt. The key difference in the cost of debt before and after taxes lies in the fact that interest expenses are tax-deductible. For investment grade bonds, the difference between the expected rate of return and the promised rate of return is small.

The cost of debt metric is also used to calculate the Weighted Average Cost of Capital , which is often used as the discount rate in discounted cash flow analysis. These are the capital asset pricing model, the dividend discount model, and the bond yield plus risk premium method. Firms report the book value of debt on their financial statements and not their bank debt. Also, the market value of debt helps analysts to calculate the enterprise value of a firm, which is higher than the market cap if the company carries a lot of debt. For an investment with a defined time horizon, such as a new-product launch, managers project annual cash flows for the life of the project, discounted at the cost of capital.